The U.S. Department of Education (ED) has sought to establish a definition of Gainful Employment (GE) for over a decade, and in more recent years, we’ve seen regulatory whiplash as priorities and opinions change.

An initial attempt to establish a rule by the Obama administration was thrown out in a legal challenge (GE 1.0). A second attempt was then established (GE 2.0), but it was terminated by the Trump administration. Now, the Biden administration proposed a new GE regulation (GE 3.0) as part of the Institutional and Programmatic Eligibility Negotiated Rulemaking sessions, which concluded on March 18, 2022. While consensus was not reached, ED put forth a framework that provides a roadmap for a rule expected to be proposed by ED. The proposed rule is likely to have some similarities to the previous one, but there are interesting new concepts being introduced that could make it more onerous to pass.

We expect the proposed regulations will restore tests that could cause a GE program to lose eligibility to receive Title IV funding or require significant disclosures to students enrolled in or considering enrolling in GE programs. While we support efforts to measure outcomes for graduates of programs, we are concerned the potential regulations impose requirements that jeopardize the eligibility of programs in certain fields without accurately reflecting the benefits for its graduates.

In an unexpected announcement on June 21, 2022, ED indicated that GE 3.0 rules will not be issued prior to November 1, 2022, and, as such, will not be effective as of July 1, 2023. We expect the proposed rules will be published in time to be effective July 1, 2024. What is interesting is that the Biden administration will not accomplish issuing a GE metric with multiple years of potential consequences prior to the next presidential election, and this seemed to be a high priority for ED. It poses a theoretical question as to what impact the pandemic and Higher Education Emergency Relief Funding had on issuing these regulations. Maybe the Biden administration determined the impact of COVID on student earnings was too detrimental to issue the regulations at this time.

In the meantime, this article intends to predict key aspects expected to be included in GE 3.0 based upon the information provided by ED during negotiated rulemaking. We will also cover the calculations and outcomes, issuance of rates, disclosures and results of failure, and reporting under the potential regulations.

Calculations and Outcomes

Historically, the theory of a GE regulation has been to ensure the debt burden of any graduate isn’t too burdensome compared to their post-graduation earnings. To accomplish this, GE rule 3.0 will measure the debt of a specific program as compared to the graduates’ median earnings (Debt-to-Earnings or D/E). GE 3.0 is adding a new test to determine if the program is enabling the graduate to earn more than a high school graduate. This test would measure the graduates’ earnings compared to a baseline earnings of high school graduates’ (Earnings Threshold). If either test is not passed, then the program would deem to be failing. The D/E ratio is like the previous regulations, while the Earnings Threshold test is a new metric which could be a significant barrier to pass for some programs.

The potential regulation would be applicable to any program at a proprietary institution and all non-degree programs at public institutions and private nonprofits (all defined as GE programs). The new rule also imposes disclosure requirements on all institutions to increase the transparency of GE program outcomes.

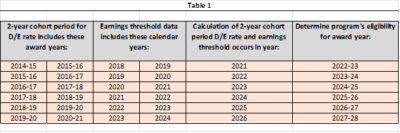

To compute the D/E ratio, ED will utilize a two-year cohort of students, unless there are less than 30 students in the two-year cohort, in which case a four-year cohort will be used). For the two-year cohort period, the D/E ratio will use the third and fourth award years prior to the year for which the most recent earnings data are available, with the information coming from a federal agency with earnings data at the time the D/E rates and Earnings Threshold measure are calculated. For the four-year cohort period, the D/E rate will instead use the third, fourth, fifth and sixth award years prior to the year for which the most recent data are available. Programs which require a medical or dental internship or residency have longer cohort periods. (See Table 1 for a summary of the cohort periods in the D/E and Earnings Threshold calculations.)

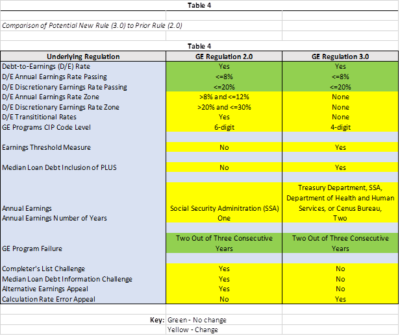

The earnings for a GE program will be identified by its Classification of Instructional Program (CIP) code. One big difference from the prior rule is that a GE program will be identified at the four-digit CIP code instead of the six-digit CIP code. The additional digits in the CIP code provide more differentiation between programs, so the switch to the four-digit CIP means that median earnings will be calculated using a broader range of job classifications. This will aggregate a larger number of programs into the D/E and Earnings Threshold rate calculations.

Similar to the prior rule, the D/E ratio will have an annual rate and a discretionary rate computed. The D/E rate will include the Median Loan Debt of the students who completed the program during the cohort period. Loan Debt includes:

- Title IV aid (including Direct Plus Loans, which is new)

- Any private education loan including loans made by the institution

- Any amount outstanding, as of the date the student completes the program extended by the institution, for which the student is obligated to repay (in essence, this is any unpaid accounts receivable amount)

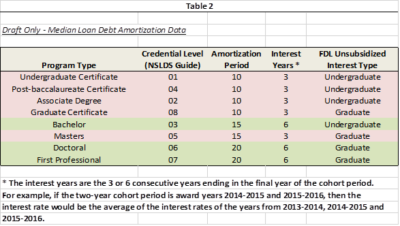

The Median Loan Debt will be the lesser of the Loan Debt or the total amount the Institution received for tuition, fees, books, equipment and supplies. This caps the debt at the cost of the program. ignoring loans obtained for personal living expenses. However, there is no priority for Pell grants similar to the Presumptive Rule for the 90/10 calculation. Thus, any loans received up to the cost of the program are included, even if the student received a stipend for personal living expenses. The potential rule has a stipulation that if students who completed the program during the cohort period are unable to be matched to the Federal agency providing earnings data, then the same number of students with the highest loan debts are excluded from the Median Loan Debt calculation. The Median Loan Debt will be amortized over a 10-, 15- or 20-year repayment period, using an average interest rate based upon the GE program credential. The number computed is the Annual Loan Payment. (See Table 2 for the amortization years and interest rates.)

ED will then obtain from a federal agency the most currently available Median Annual Earnings of the students who completed the GE program during the cohort period and who do not meet one of the exclusions. This number is the Median Annual Earnings. The D/E rates are computed as follows:

- Annual Earnings Rate: Annual Loan Payment divided by the Median Annual Earnings. A rate of 8% or less is passing and a rate over 8% is failing.

- Discretionary Earnings Rate: Annual Loan Payment divided by the sum of the Median Annual Earnings, less 1.5x the Poverty Guideline. For the purposes of this paragraph, ED will apply the Poverty Guideline for the calendar year immediately following the calendar year for which annual earnings are obtained. A rate of 20% or less is passing and a rate over 20% is failing.

- A GE program becomes ineligible for Title IV funds if it fails the D/E rates in two out of any three consecutive years for which the D/E rates are calculated.

The regulations indicate the earnings will be taken from the two most recent available earnings years, and it is not yet clear how two years of wages will be aggregated to compute the Annual Earnings Rate. (Will this be the higher of the two years? An average?) The previous GE regulations pulled earnings data from only one calendar year. See Table 1 for the earnings year to be utilized, compared to the cohort data years.

Once a GE program is determined to have passed one of the D/E rates, the Earnings Threshold Measure must be computed. This ratio is simpler but could be difficult to pass for many GE programs, especially those in fields of study in which earnings are realized further in the future (e.g., cosmetology, culinary, arts). ED will compute the Earnings Threshold, which will be based on data from the Census Bureau for a working adult aged 25-34 with only a high school diploma (or GED):

- In the state in which the institution is located; or

- Nationally, if fewer than 50 percent of the institution’s students are located in the state where the institution is located.

The Earnings Threshold Measure is computed as the Median Annual Earnings compared to the Earnings Threshold.

- If the Median Annual Earnings exceeds the Earnings Threshold, the GE program passes.

- If the Median Annual Earnings is equal to or less than the Earnings Threshold, the GE program fails.

- A GE program becomes ineligible for Title IV funds if it fails the Earnings Threshold Measure test in two out of any three consecutive years for which the D/E rates are calculated. Similar to GE 2.0, student warnings will be required after a single failure.

GE programs which have less than 30 students in a four-year cohort would be deemed to be a Small Program and would be aggregated at the institution by Credential Level (see Table 2 above for the Credential Levels). A D/E rate and an Earnings Threshold Measure would be computed in total for these Small Programs, and this would be deemed the Small Program Rate. A failing Small Program Rate would not make these programs ineligible, but it would be reported in the GE disclosures. If a D/E rate or an Earnings Threshold Measure is not computed for an award year or ED calculates only a Small Program Rate, the GE program receives no result under the regulations and remains in the same status as the previous award year.

M&A Analysis

Our initial take is that the potential GE rule is more onerous for institutions to pass due to the following reasons:

- Inclusion of PLUS loans in the Median Loan Debt (the parent earnings are not included in the denominator),

- The elimination of the D/E rate zone (>8% and <=12% for annual earnings rates and >20% and <=30% for discretionary earnings rates), and

- The new metric related to the Earnings Threshold Measure.

Additionally:

- Unlike the GE 2.0, no earnings appeal process is currently being contemplated, which will impact GE programs with systemic underreporting of income. In, addition, appeals for the completer list and debt level also does not exist.

- The aggregation of GE programs at the 4-digit versus the 6-digit CIP code level may help or hurt institutions depending on the specific GE programs. Negotiators had concerns that the aggregation at the 4-digit CIP code level would capture GE programs that were unrelated to each other and therefore, not provide a transparent D/E rate or Earnings Threshold Measure.

- Many institutions may have modified program cost structures and lengths based upon the previous GE regulations along with eliminating certain programs.

- The closure of institutions in the last few years may have removed programs potentially at-risk of failing the previous GE regulations, and,

- The inputs for GE 3.0 are all in the past so management is unable to take any action prior to the first-year rates being computed.

Institutions should begin to review their GE programs to determine the impact. Median Loan Debt could be estimated from data in the institution’s student information system and Bureau of Labor Statistics information could be utilized for the denominator, unless the institution has earnings data from internal surveys.

Issuance of Rates

The process ED will follow has similarities to the previous rule. ED will compile a list of students enrolled in GE programs and remove the students who meet certain exclusions, including situations such as permanent and total disability, death, and enrollment in post-secondary education. ED will provide this list to a federal agency, which could include the Treasury Department, Social Security Administration, the Department of Health and Human Services or the Census Bureau to obtain earnings data. The federal agency must have earnings data to match with at least 90% of Title IV recipients who completed the program during the cohort period. The federal agency will return the Median Annual Earnings for the students on the list who have been matched to earnings data in their system. The Median Annual Earnings will be in aggregate and not on an individual basis. In addition, the federal agency will indicate the number of students not matched (identities not provided).

If the earnings data provided includes at least 30 students, ED will compute the D/E rates and the Earnings Threshold Measure. At this point, ED will exclude from the Median Loan Debt the same number of students with the highest loan debt equal to the number of students not matched in the earnings data. For example, if the federal agency is unable to match three out of 100 students, the three highest student loan debts will be excluded from the Median Loan Debt calculation.

Subsequent to this process, for each award year, ED will publish the D/E rates and the Earnings Threshold Measure, along with the Small Program Rates, and whether each GE program is passing, failing or ineligible. ED will also indicate if the GE program could become ineligible based upon the rates for the next award year and whether the institution is required to issue students warnings. For a program which has been deemed to be ineligible, Title IV participations ends upon signing a new Program Participation Agreement, which excludes the program, completion of a termination action of a program’s eligibility or revocation of program eligibility, if institution is provisionally certified. Institutions may not dispute a GE program’s ineligibility based upon the D/E rate or Earnings Threshold Measure.

This process reflects some significant changes to the detriment of institutions. In the previous GE regulation, institutions had the ability to appeal the list of completers and the median loan debt along with an alternative earnings appeal process. In addition, transition rates were computed which used Median Loan Debt of students who completed the GE program in the most recent award year to account for changes institutions may have made to the cost structure. All these appeals and transitional period flexibility are not included in the potential regulation. These rates could potentially have the impact of COVID-19 on students’ earnings without a transition or ability to appeal. An institution can appeal ED’s action if it believes there is an error in the calculation of the D/E rates or Earnings Threshold Measure.

Disclosures and Results of Failure

For GE programs which have been deemed to have failed, disclosures to current and prospective students are required. Clearly students need to be aware of any GE program which is at risk of losing Title IV funding and the GE warnings are reminiscent of the previous regulations. The warnings are required to be provided to current and prospective students addressing the impact of the loss of Title IV aid and an attestation that the student has seen the warning must be obtained. The warnings will need to include language surrounding academic and financial options, if the institution will continue to provide the program, refunds for institutional charges, and articulation agreements and teach-out plans in place. The warning must be delivered to each student enrolled in the GE program within 30 days of ED’s notice of determination. Similarly, the warning must be provided to prospective students at the first contact about the GE programs and the warning can be provided in written, via email and orally depending on the type of interaction. Specific criteria exist for each situation and an institution may not enroll, register, or enter any financial commitment with the prospective student in regard to the GE program earlier than three business days after student complete the required attestation.

For a GE program deemed to be ineligible under the D/E rate or the Earnings Threshold Measure, an institution can’t reestablish this program for three years following the date specific in the notice of determination from ED. If an institution voluntarily discontinues a program due to a failing D/E rate or Earnings Threshold Measure, the institution must wait three years from the program’s discontinuance before it can be reestablished.

One change from the previous regulation is that ED will be hosting and maintaining a website with GE information. The information that may be listed on the website includes:

- Primary occupation,

- Length of program, loan repayment rate (as calculated by ED),

- Total cost of tuition and fees (cost of books, supplies and equipment),

- Percentage of individuals who received a private loan or Title IV loan,

- Median loan debt (as computed by ED),

- Completion and withdrawal rates for full-time and less-than-full-time students (as calculated by ED or reported to ED),

- Median earnings (as provided by ED),

- Programmatic accreditation, if required, and

- Potentially new supplementary performance measures.

The supplementary performance measures may include withdrawal rate, D/E rates, Earnings Measure Threshold, small program rates, educational spending and job placement rate (if required by an accrediting agency or state), and licensure pass rate. The educational spending would reflect the amount an institution spent on instruction/instructional activities, academic support, and support services with a separate report for recruiting activities, advertising and other pre-enrollment expenditures as provided by a disclosure in the audited financial statements (included as 668.13(e)(iv) during Negotiated Rulemaking). These terms will be specifically defined as part of NPRM.

Reporting

To calculate and publish the GE metrics, a significant amount of information must be reported by all institutions to ED. Institutions will report information on enrolled, withdrawn and completed students. This information will include, not all inclusive, student names, GE program structural data (name, CIP Code, credential level and length), enrollment dates, attendance dates and enrollment status (full-time, half-time, etc.) for all students. In addition, institutions will report information related to total private educational loans, total amount of institutional debt, total amount of assessed tuition and fees, total amount of allowances for books, supplies and equipment (included in the student’s Title IV cost of attendance) and the date of separation for withdrawn and completed students.

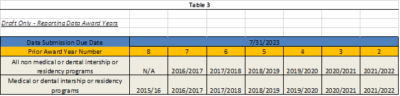

Institutions must report this information no later than the July 31 following the date these regulations take effect. Thus, the initial cohort of information spanning multiple years is most likely to be due by July 31, 2024. Institutions must ensure their SIS can pull the applicable information and should begin now to assess their system capabilities. (See Table 3 which reflects the cohort years which was included in the NegReg discussions and when the proposed rule is formally released.)

Final thoughts

When the administration will issue proposed regulations on all of the topics discussed during the 2021 and 2022 negotiated rulemakings meetings is yet to be seen.

Considering the potential impacts on GE programs and more specifically on certain GE programs such as Cosmetology, Medical Assisting and Culinary, institutions must closely monitor the proposed regulations when they are issued and begin by understanding the regulations which were proposed in the negotiated rule making process. Table 4 provides a high-level comparison of the prior GE rule (GE 2.0) versus the GE regulations proposed during negotiated rule making (GE 3.0). This is a good place to start, but stay tuned for further guidance.