The FASB Accounting Standards Update (ASU) 2018-08, Not-For-Profit Entities (Topic 958), Clarifying the Scope and the Accounting Guidance for Contributions Received and Contributions Made, is now effective for fiscal years ending June 30, 2020. Affected organizations must fully understand the update, including some potential challenges created by it.

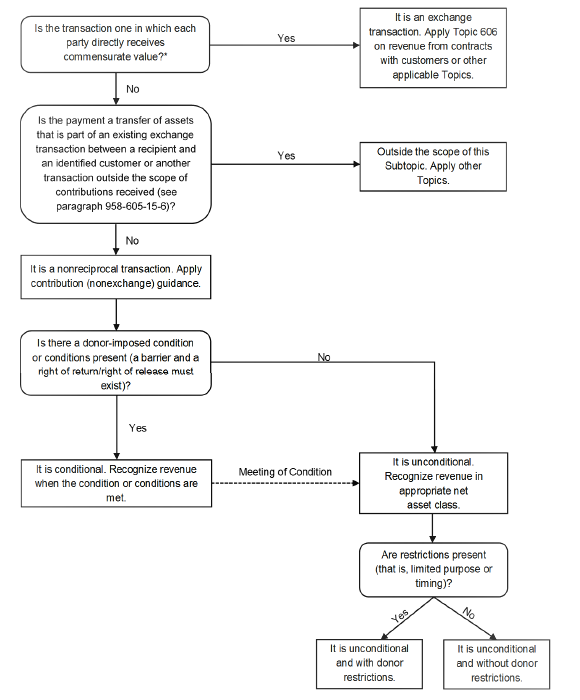

While the FASB update has revised certain definitions for “Conditional Promises to Give”, “Contributions” and “Donor-Imposed Conditions,” with the intent to make them clearer, it also provides not-for-profit organizations with guidance clarifying whether gifts, grants or contracts should be accounted for as contributions or as exchange transactions. The guidance for Contributions is included under the Accounting Standards Codification (ASC) 958, Not-for-Profit Entities, while Exchange transactions are primarily accounted for under ASC 606, Revenue from Contracts with Customers, or potentially other topics. In order to help organizations better understand the impact of ASU 2018-08, the FASB has included the following diagram within the guidance:

The expectations under the improved guidance are that more grants and contracts would be accounted for as contributions than under the old guidance. However, the challenge under this new guidance when analyzing potential exchange transactions is to determine if there is commensurate or equal value received and how to measure it. It is important for organizations to do a thorough review of their grant agreements and contracts to ensure they understand who is receiving the primary benefit.

For any questions related to ASU-2018-08, please feel free to reach out to McClintock & Associates for assistance.